-

Köp böcker som pensionär

Köp böcker som pensionär

-

Förnya ditt läsrum på ett billigt sätt

Förnya ditt läsrum på ett billigt sätt

-

Förnya ditt läsrum på ett billigt sätt

Förnya ditt läsrum på ett billigt sätt

-

Få ihop pengar till nya böcker

Få ihop pengar till nya böcker

-

Satsa på internationell bokförsäljning

Satsa på internationell bokförsäljning

-

Så skyddar du dina böcker vid transport

Så skyddar du dina böcker vid transport

-

Spel och böcker för alla

Spel och böcker för alla

-

Ny väggfärg ger större läsro

Ny väggfärg ger större läsro

-

Är du nästa svenska deckardrottning?

Är du nästa svenska deckardrottning?

-

Ta hand om bostadsrättsföreningen och njut av dina böcker

Ta hand om bostadsrättsföreningen och njut av dina böcker

-

Skriv en bästsäljare

Skriv en bästsäljare

-

Köpa och sälja böcker second hand

Köpa och sälja böcker second hand

-

Läs på rätt sätt inför högskoleprovet

Läs på rätt sätt inför högskoleprovet

-

Böcker i skolans värld

Böcker i skolans värld

-

Så förbättrar du dina betyg

Så förbättrar du dina betyg

-

4 banbrytande böcker inom filosofi

4 banbrytande böcker inom filosofi

-

Sjöwall/Wahlöö

Sjöwall/Wahlöö

-

Selma Lagerlöf

Selma Lagerlöf

-

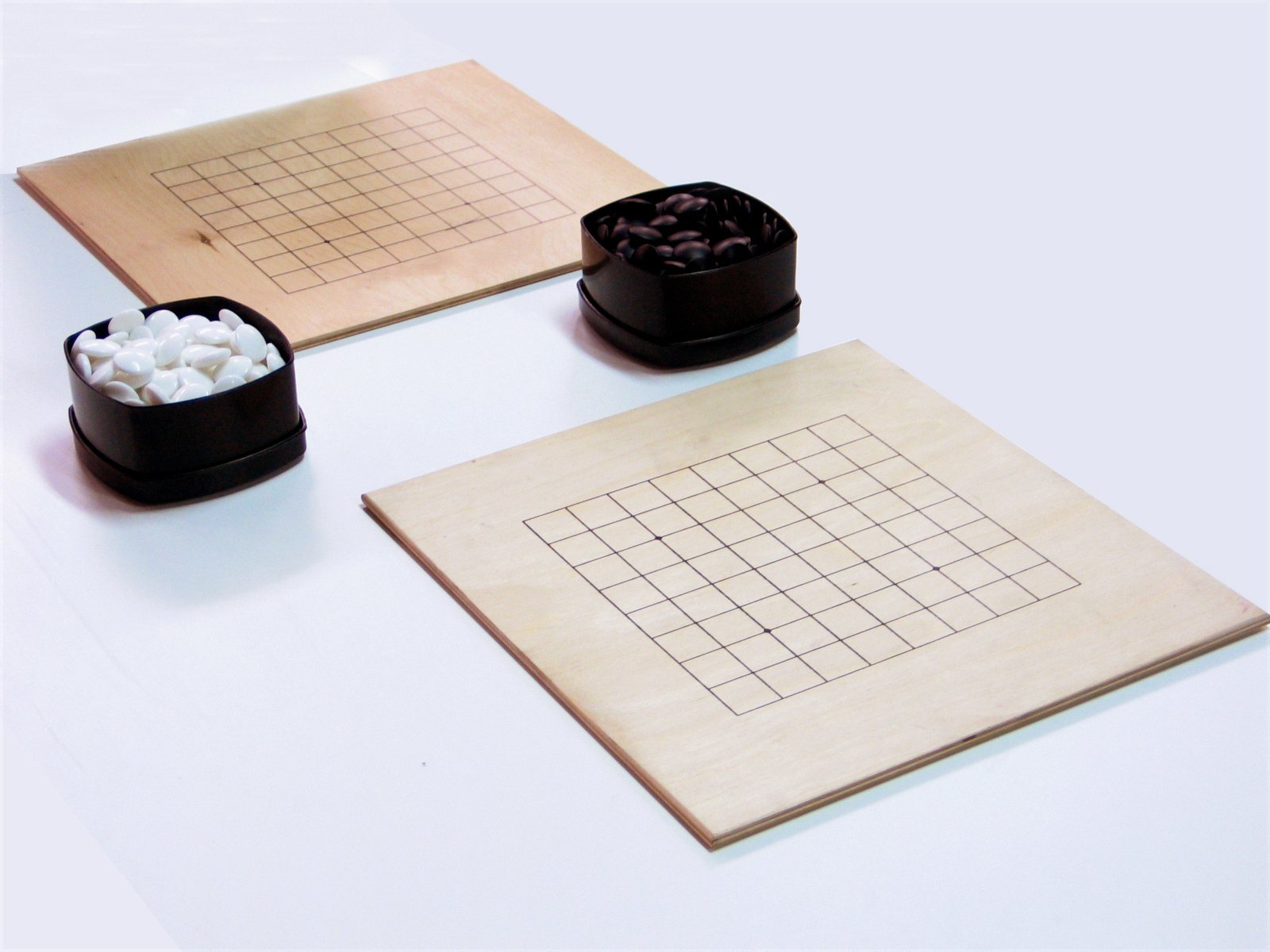

Master of Go - Yasunari Kawabata

Master of Go - Yasunari Kawabata

-

Eyvind Johnson och Harry Martinson

Eyvind Johnson och Harry Martinson

-

David Lagercrantz - fortsättningen på Millenium

David Lagercrantz - fortsättningen på Millenium

-

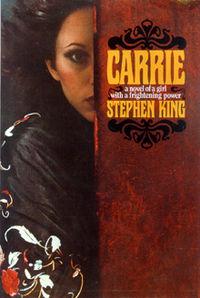

Carrie

Carrie

-

Mo Yan

Mo Yan

-

Svetlana Aleksijevitj

Svetlana Aleksijevitj

-

Stieg Larsson - Milleniumtrilogin

Stieg Larsson - Milleniumtrilogin

-

Leif GW Persson - En roman om ett brott

Leif GW Persson - En roman om ett brott

-

22/11 1963

22/11 1963

-

Den gröna milen

Den gröna milen

-

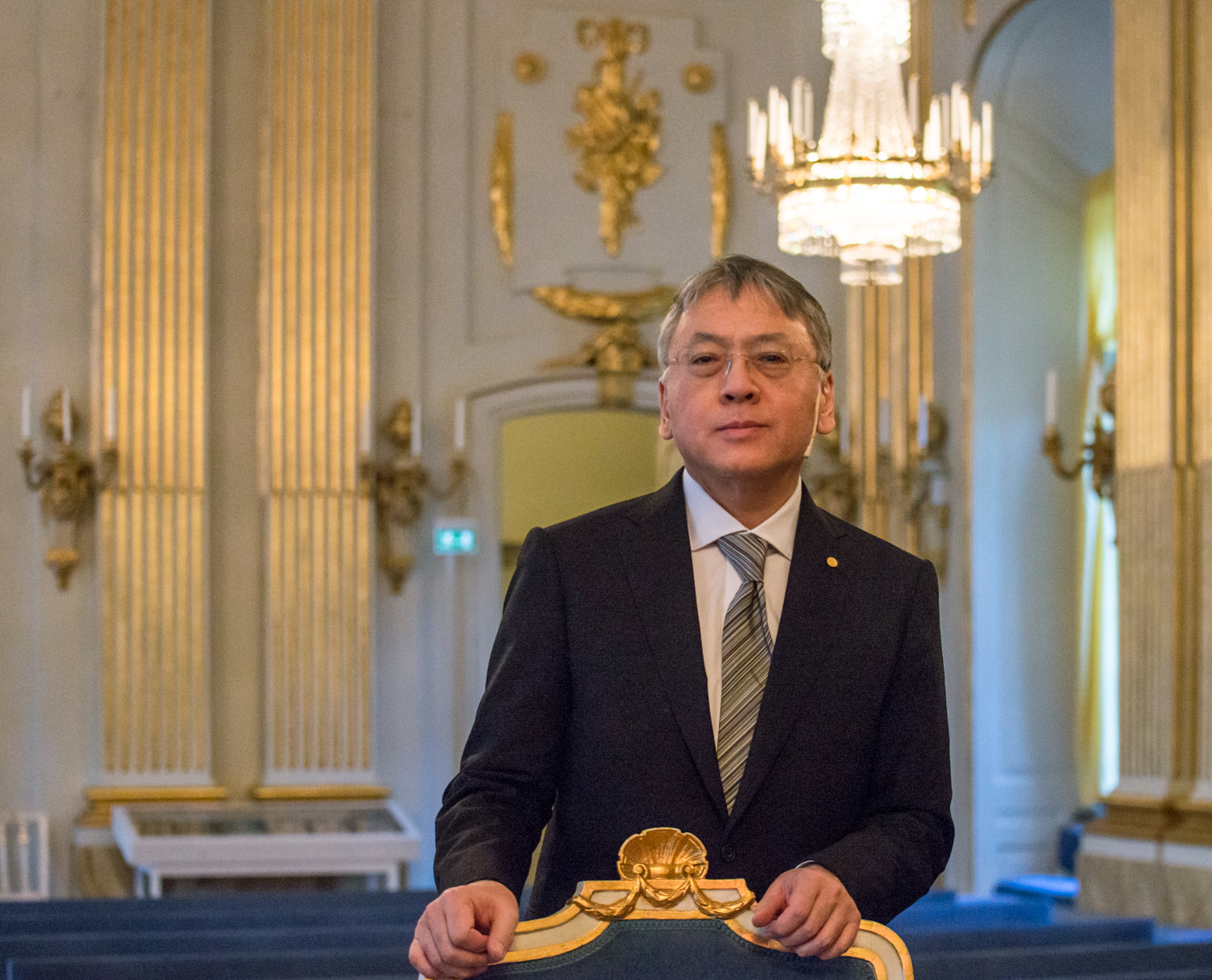

Kazuo Ishiguro

Kazuo Ishiguro

-

John Steinbeck

John Steinbeck